Antrag Auf Steuerklassenwechsel Bei Ehegatten Lebenspartnern Pdf

The Antrag auf Steuerklassenwechsel bei Ehegatten/Lebenspartnern (Application for Change of Tax Class for Spouses/Registered Partners) is a crucial document for married couples and registered partners in Germany to optimize their income tax burden. Understanding this form and the process behind it can lead to significant financial advantages. This article provides a comprehensive guide to help you navigate the application process.

Understanding the German Tax Class System for Married Couples/Registered Partners

In Germany, the tax system for married couples and registered partners differs significantly from that for single individuals. The primary aim is to distribute the tax burden fairly based on income disparities. Three main tax class combinations are available:

- Tax Class III/V: One partner chooses tax class III, and the other chooses tax class V. Tax class III is generally more favorable as it allows for higher tax-free allowances. This combination is typically beneficial when one partner earns significantly more than the other.

- Tax Class IV/IV: Both partners choose tax class IV. This is suitable when both partners earn roughly the same amount.

- Tax Class IV/IV with Factor (Faktor): This is also used when both partners have income, but it aims for a more precise tax calculation, especially when incomes are not perfectly equal. The factor is calculated annually by the tax office to minimize discrepancies between monthly deductions and the final annual tax liability.

When to Consider a Tax Class Change

A tax class change might be beneficial in several situations:

- Marriage or Registered Partnership: Upon getting married or entering a registered partnership, you'll automatically be assigned tax class IV/IV. Evaluate whether III/V or IV/IV with Factor would be more advantageous.

- Significant Change in Income: If one partner experiences a considerable increase or decrease in income (e.g., due to a new job, job loss, or parental leave), a change to III/V might be warranted.

- Birth of a Child: While the birth of a child doesn't automatically trigger a tax class change requirement, it can influence whether a different tax class combination would be more financially beneficial, particularly in combination with Elterngeld (parental allowance).

- Retirement: As income patterns change in retirement, reassessing your tax class combination is advisable.

- Divorce or Dissolution of Registered Partnership: Following a divorce or dissolution, you'll need to revert to a single tax class (usually I).

Obtaining the Application Form: Antrag auf Steuerklassenwechsel bei Ehegatten/Lebenspartnern

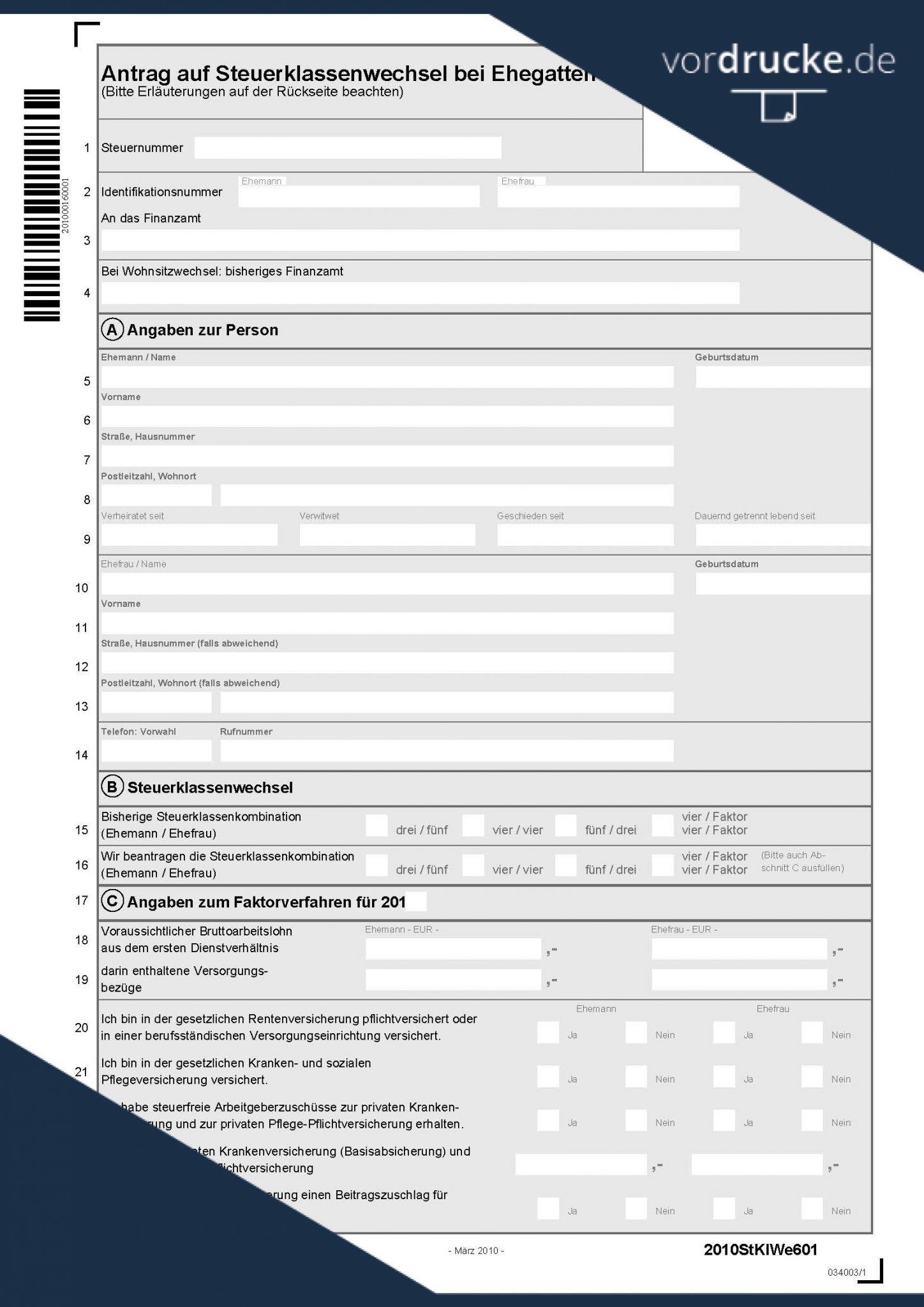

The application form, titled Antrag auf Steuerklassenwechsel bei Ehegatten/Lebenspartnern, is readily available online. You can download it from the website of the Bundeszentralamt für Steuern (BZSt – Federal Central Tax Office) or from your local Finanzamt (tax office) website. You can also obtain a physical copy directly from your local Finanzamt. Make sure you download or obtain the most current version of the form. A PDF version is commonly used, which is where the extension "Pdf" in the document title comes from.

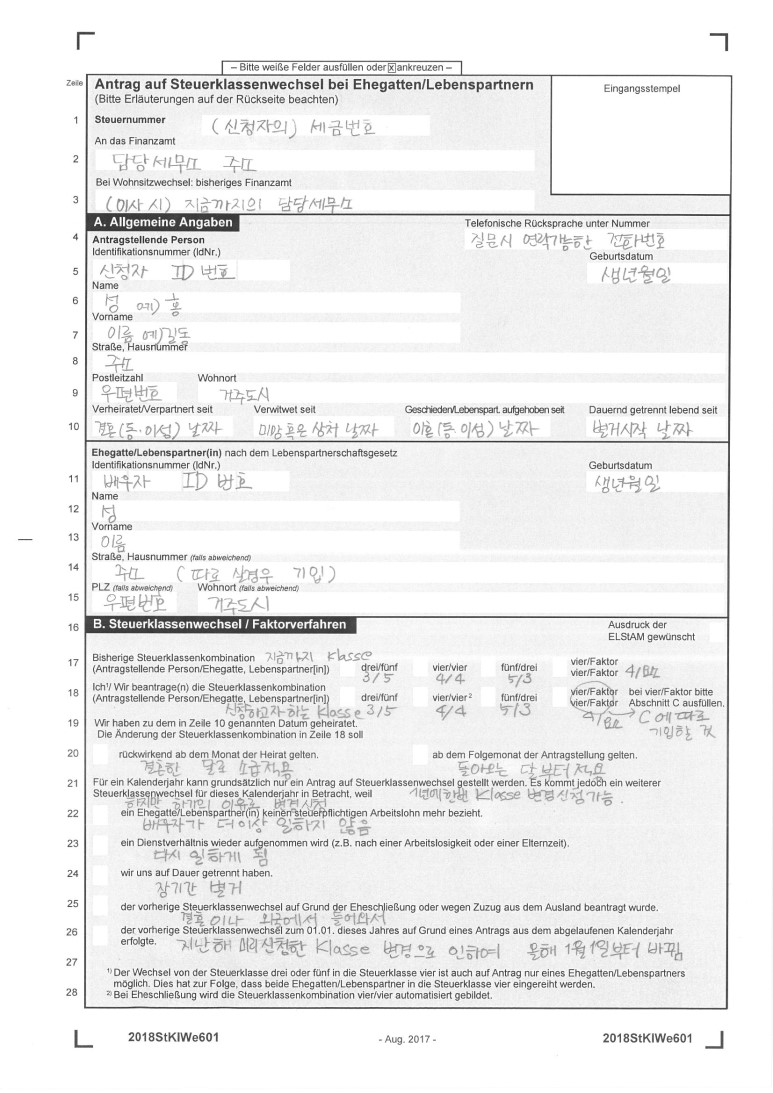

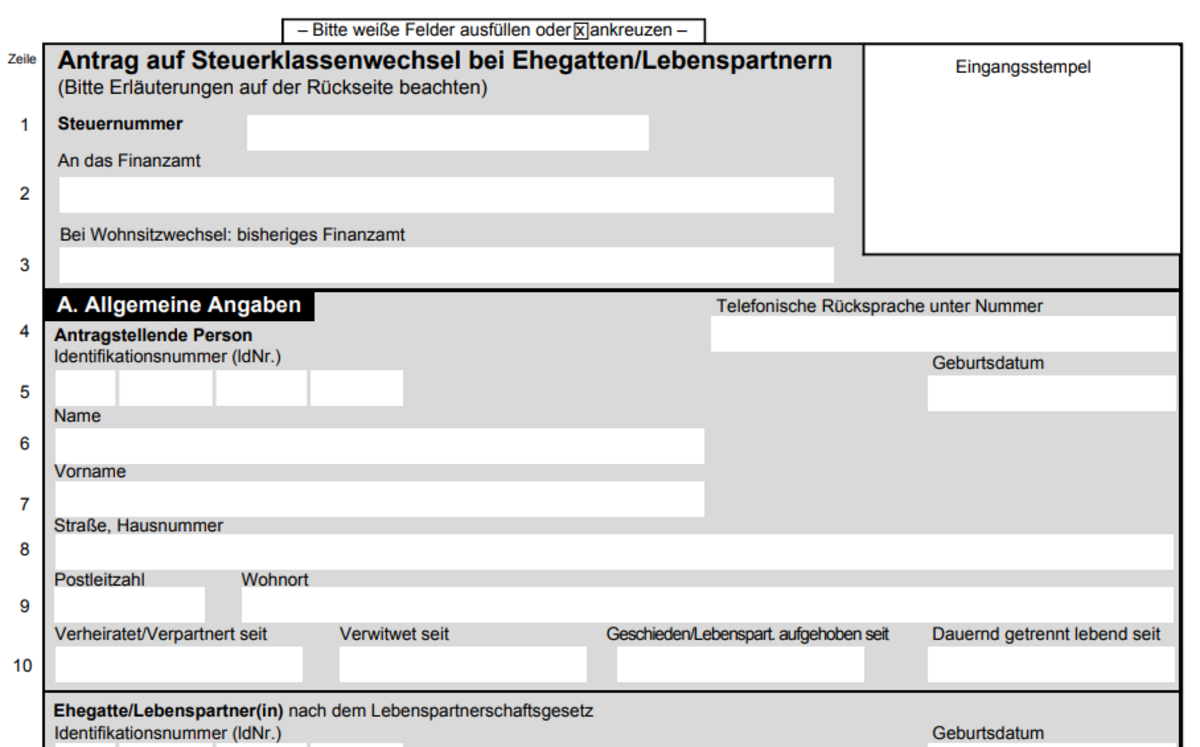

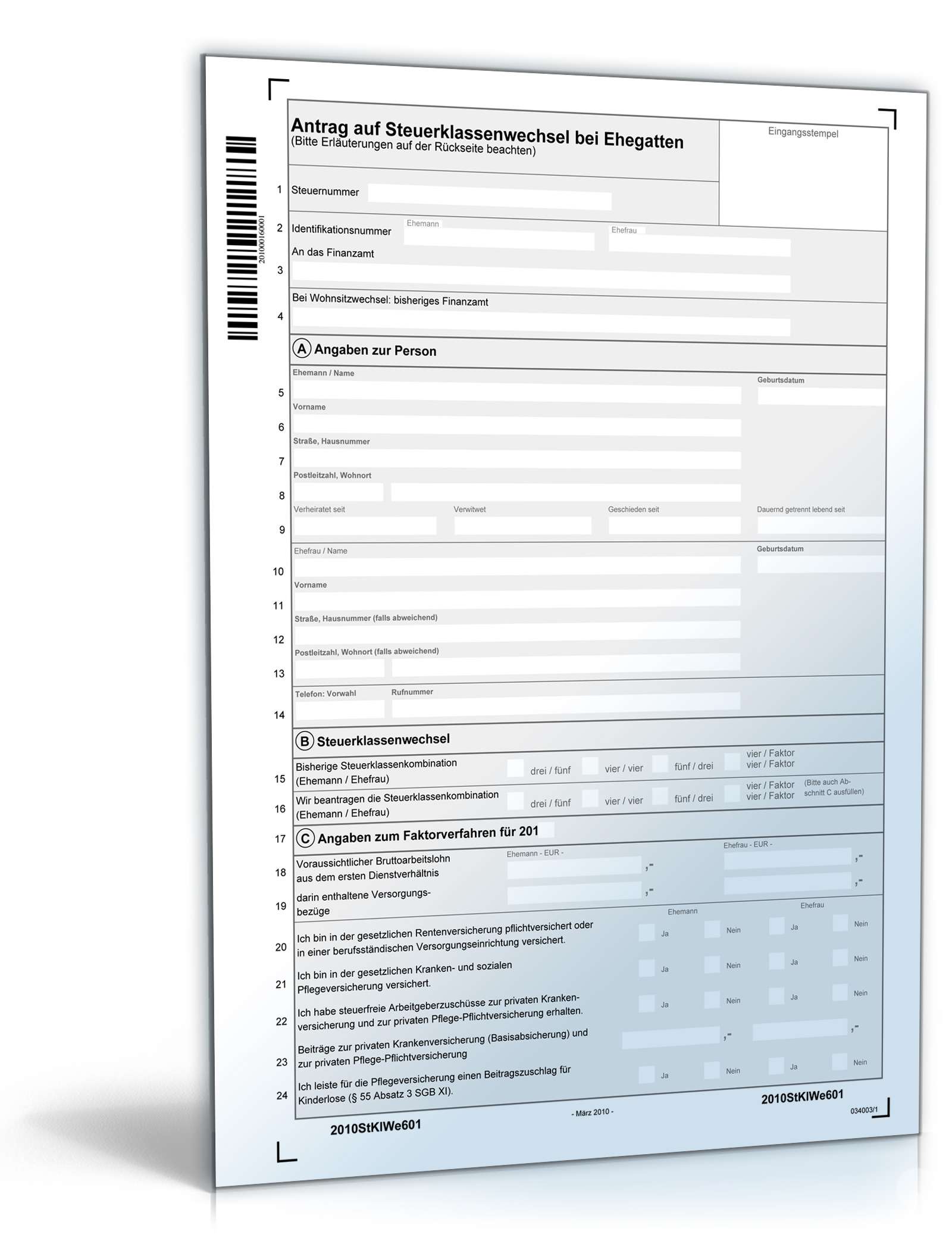

Completing the Form: A Step-by-Step Guide

The application form requires careful and accurate completion. Here's a breakdown of the key sections:

- Personal Information (Angaben zur Person): This section requires details for both partners, including:

- Name (Last name, first name)

- Geburtsdatum (Date of birth)

- Steueridentifikationsnummer (Tax identification number – important!)

- Anschrift (Address)

- Familienstand (Marital status – married or registered partnership)

- Religionszugehörigkeit (Religious affiliation – for church tax purposes)

- Previous Tax Class (Bisherige Steuerklasse): Indicate your current tax class.

- Desired Tax Class (Gewünschte Steuerklasse): Clearly state the new tax class combination you are applying for (e.g., III/V, IV/IV, or IV/IV with Factor).

- Justification for Change (Begründung für den Wechsel): While not always mandatory, briefly explain the reason for your tax class change request. This can be especially helpful when applying for IV/IV with Factor, as you need to demonstrate a change in income circumstances.

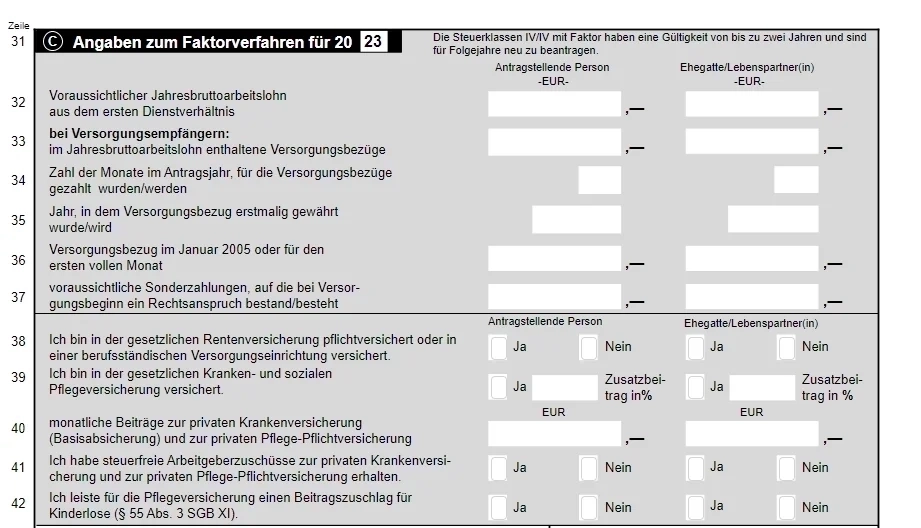

- Details for Tax Class IV/IV with Factor (Angaben zur Steuerklassenkombination IV/IV mit Faktor): If applying for IV/IV with Factor, provide details of the voraussichtliche Arbeitslohn (expected gross income) for both partners for the current calendar year. This is essential for the Finanzamt to calculate the correct factor. You will also need to declare whether one or both partners are receiving or applying for Lohnersatzleistungen (wage replacement benefits) such as unemployment benefits, sickness benefits, or parental allowance.

- Signature (Unterschrift): Both partners must sign and date the form.

Submitting the Application

Once completed, the Antrag auf Steuerklassenwechsel bei Ehegatten/Lebenspartnern can be submitted to your local Finanzamt in the following ways:

- By Post: Send the signed form to the address of your local Finanzamt. You can find the address on the Finanzamt's website.

- In Person: You can deliver the form directly to the Finanzamt during its opening hours.

- Electronically (via ELSTER): If you have an ELSTER certificate, you can submit the application electronically. This is often the fastest and most convenient method.

Important Considerations

- Deadlines: The application generally needs to be submitted by November 30th to be effective for the following calendar year. However, you can usually change your tax class multiple times within a year if circumstances warrant it.

- Accuracy: Ensure all information provided on the form is accurate and up-to-date. Incorrect information can lead to incorrect tax deductions and potential penalties.

- Supporting Documentation: While not always required, it's a good idea to keep supporting documentation handy, such as payslips or proof of income, especially when applying for IV/IV with Factor.

- Impact on Social Benefits: Be aware that your tax class can affect certain social benefits, such as Elterngeld (parental allowance) and Arbeitslosengeld (unemployment benefits). Research the potential impact before making a change. For Elterngeld, the tax class valid for the majority of the 12 months preceding the birth of the child is relevant.

- Consult a Tax Advisor: If you are unsure about which tax class combination is best for your situation, consider consulting a tax advisor (Steuerberater). They can provide personalized advice tailored to your specific financial circumstances.

After Submission

After submitting the application, the Finanzamt will process your request. You will receive a confirmation letter (Bescheid) indicating your new tax class combination. This information will be automatically transmitted to your employer(s), and your tax deductions will be adjusted accordingly. Verify the information in the confirmation letter to ensure its accuracy.

Tax Class Change and Mini-Jobs

If one spouse holds a mini-job (Minijob), the choice of tax class can become more nuanced. While a mini-job is generally taxed at a flat rate, it still counts towards the overall income of the household. Therefore, a tax class change, especially to III/V, should consider the combined effect of the regular income and the mini-job income.

Conclusion

Understanding the Antrag auf Steuerklassenwechsel bei Ehegatten/Lebenspartnern and the German tax class system is essential for optimizing your tax situation as a married couple or registered partnership. By carefully considering your income circumstances and completing the application accurately, you can ensure that you are paying the correct amount of tax and potentially benefiting from significant financial advantages. If in doubt, seek professional advice from a tax advisor to ensure you make the most informed decision.