Herzlichen Glückwunsch Ihr Kredit Wird In Kürze Ausgezahlt Auxmoney

The phrase "Herzlichen Glückwunsch, Ihr Kredit wird in Kürze ausbezahlt auxmoney" translates to "Congratulations, your loan will be disbursed shortly by auxmoney." This message indicates that your loan application with auxmoney has been approved, and the funds are on their way to your account. Understanding the implications of this message and the subsequent steps is crucial, especially for expats and newcomers to Germany who may be unfamiliar with the local lending practices.

Understanding Auxmoney

Auxmoney is a prominent online credit marketplace (Kreditmarktplatz) in Germany. Unlike traditional banks, Auxmoney connects borrowers directly with private and institutional investors. This peer-to-peer (P2P) lending model can offer several advantages, including potentially lower interest rates and a more flexible approval process, particularly for individuals who may not meet the stringent criteria of conventional banks. Auxmoney operates as a mediator, facilitating the loan agreement and handling the disbursement and repayment processes.

Key Features of Auxmoney Loans

- Accessibility: Often more accessible to individuals with less-than-perfect credit histories or irregular income streams compared to traditional banks.

- Faster Processing: The online application and approval process can be significantly faster than traditional bank loans.

- Flexible Loan Amounts and Terms: Auxmoney offers a range of loan amounts and repayment terms to suit individual needs.

- Transparency: The platform generally provides clear information about interest rates, fees, and repayment schedules.

Decoding "Herzlichen Glückwunsch Ihr Kredit Wird In Kürze Ausgezahlt"

Let's break down what this message specifically means for you:

- Herzlichen Glückwunsch: This is a formal congratulatory phrase indicating that your loan application has been successful.

- Ihr Kredit wird in Kürze ausbezahlt: This signifies that the approved loan amount will be disbursed to your designated bank account soon. The term "in Kürze" (shortly) doesn't specify an exact timeframe but implies that the disbursement process has been initiated.

- auxmoney: This identifies the lending platform facilitating the loan.

What Happens After Receiving This Message?

Receiving this congratulatory message is a positive step, but it's crucial to understand what to expect next:

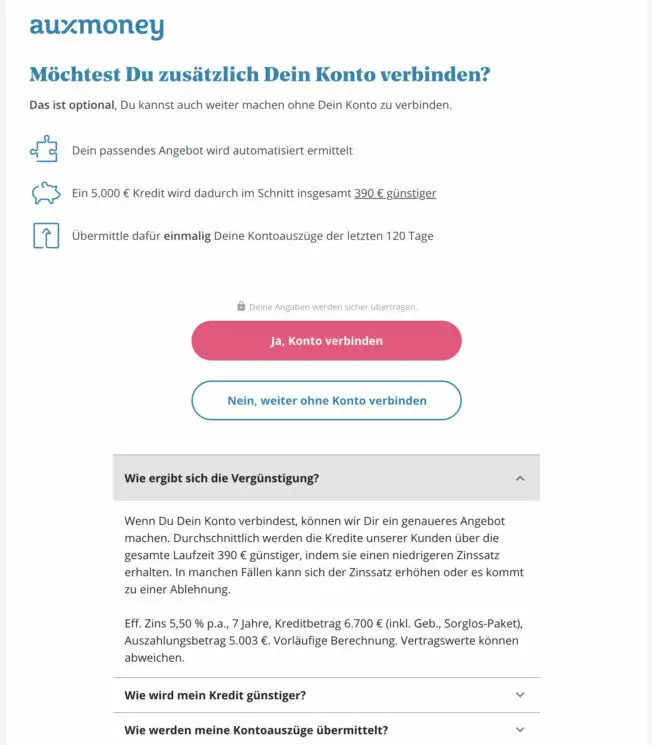

Verification and Final Checks

While the message indicates approval, auxmoney may still conduct final verification checks before the actual disbursement. These checks can include:

- Confirmation of Bank Details: Ensure that the bank account details you provided during the application process are accurate. Errors can cause delays in disbursement.

- Identity Verification: Auxmoney may require further verification of your identity to comply with anti-money laundering regulations. This could involve submitting additional documents.

- Contract Review: Carefully review the loan agreement (Kreditvertrag) sent by auxmoney. Pay close attention to the interest rate (Zinssatz), repayment schedule (Tilgungsplan), any associated fees, and the terms and conditions of the loan. Do not hesitate to ask questions if anything is unclear.

Disbursement Timeframe

The actual disbursement timeframe can vary depending on several factors, including:

- Bank Processing Times: The speed at which your bank processes incoming transfers.

- Verification Completion: The time it takes to complete any outstanding verification checks.

- Auxmoney's Internal Processes: Auxmoney's internal procedures for initiating the disbursement.

Generally, you can expect the funds to be credited to your account within 1-3 business days after receiving the "Herzlichen Glückwunsch" message. However, it's always a good idea to contact auxmoney directly if you haven't received the funds within this timeframe to inquire about the status of your disbursement.

Understanding the Loan Agreement (Kreditvertrag)

The Kreditvertrag is a legally binding document, so it's crucial to understand its terms. Key elements to review include:

- Loan Amount (Kreditsumme): The total amount of money you are borrowing.

- Interest Rate (Zinssatz): The percentage charged on the loan amount. Pay attention to whether it's a fixed or variable rate.

- Repayment Schedule (Tilgungsplan): The details of how and when you will repay the loan, including the amount of each installment (Rate) and the due dates.

- Total Cost of the Loan (Gesamtkosten des Kredits): The total amount you will repay, including principal and interest.

- Early Repayment Options (Sondertilgungsrecht): The possibility of making extra payments to reduce the loan principal and interest accrued. Understand any potential fees associated with early repayment.

- Default Penalties (Verzugsfolgen): The penalties for failing to make payments on time.

- Fees (Gebühren): Any fees associated with the loan, such as processing fees or account maintenance fees.

Potential Issues and How to Address Them

While the approval message is encouraging, issues can still arise. Here's how to handle some common scenarios:

- Delayed Disbursement: If the funds haven't arrived within the expected timeframe, contact auxmoney's customer service. Provide your loan reference number and inquire about the status of your disbursement.

- Incorrect Bank Details: If you realize you provided incorrect bank details, immediately contact auxmoney to rectify the situation. This may involve providing corrected bank statements or other documentation.

- Unexpected Fees: If you notice unexpected fees in the loan agreement, clarify them with auxmoney before signing. Do not hesitate to question any charges you don't understand.

- Unable to Repay: If you anticipate difficulties making repayments, contact auxmoney as soon as possible. They may be able to offer alternative repayment arrangements. Ignoring the problem will only worsen the situation and negatively impact your credit score (Schufa).

Tips for Managing Your Auxmoney Loan

Once your loan is disbursed, it's essential to manage it responsibly:

- Budget Carefully: Create a budget to ensure you can comfortably afford the monthly repayments.

- Set Up Automatic Payments: Automate your repayments to avoid late fees and maintain a good credit score.

- Monitor Your Account: Regularly check your auxmoney account and bank statements to track your loan balance and repayment history.

- Contact Auxmoney Early: If you anticipate financial difficulties, contact auxmoney as soon as possible to discuss your options.

- Consider Early Repayment: If you have extra funds, consider making early repayments to reduce the total interest you pay.

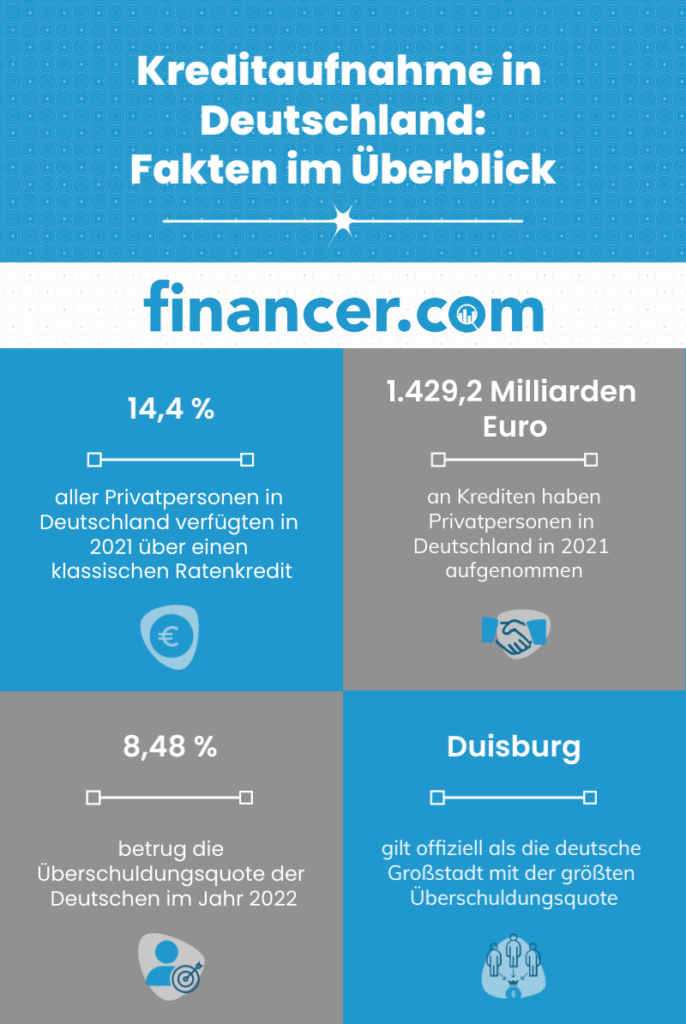

The Importance of Schufa and Credit Score

Your Schufa (Schutzgemeinschaft für allgemeine Kreditsicherung) score is a crucial factor in Germany's financial system. It's a creditworthiness assessment that lenders use to determine your risk as a borrower. A positive Schufa score increases your chances of obtaining loans, credit cards, and even rental agreements. Prompt and consistent loan repayments to auxmoney will positively impact your Schufa score. Conversely, late or missed payments will negatively affect it.

Maintain a good Schufa score by managing your finances responsibly and making timely payments on all your debts. A poor Schufa score can significantly limit your access to financial services in Germany.

Conclusion

Receiving the message "Herzlichen Glückwunsch, Ihr Kredit wird in Kürze ausbezahlt auxmoney" is a positive sign that your loan application has been approved. However, it's crucial to understand the subsequent steps, carefully review the loan agreement, and manage your loan responsibly to avoid any financial difficulties and maintain a good credit score. For expats and newcomers, understanding the nuances of the German lending system is crucial, and auxmoney can be a viable alternative to traditional banks, provided you approach it with informed awareness and responsible financial management.