Kg Handelsregister A Oder B

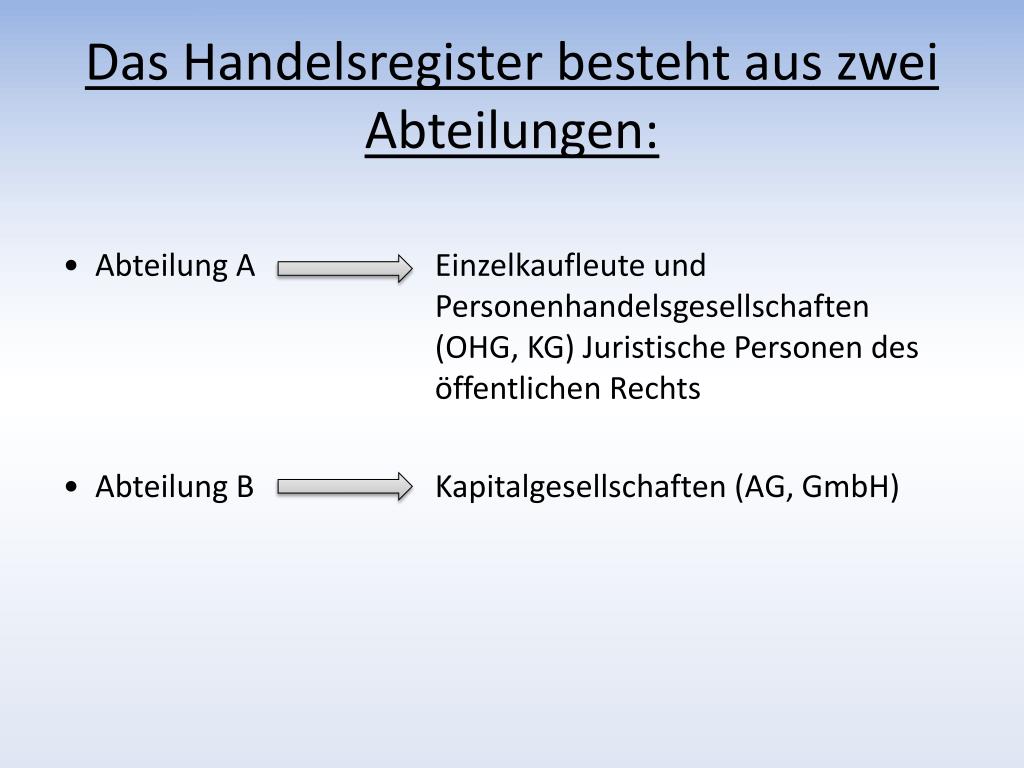

Understanding the German commercial register (Handelsregister) is crucial for anyone involved in business in Germany. The terms "Handelsregister A" and "Handelsregister B" refer to two distinct sections within this register, each pertaining to different types of business entities. Knowing which section applies to your business is essential for complying with legal requirements and conducting business effectively.

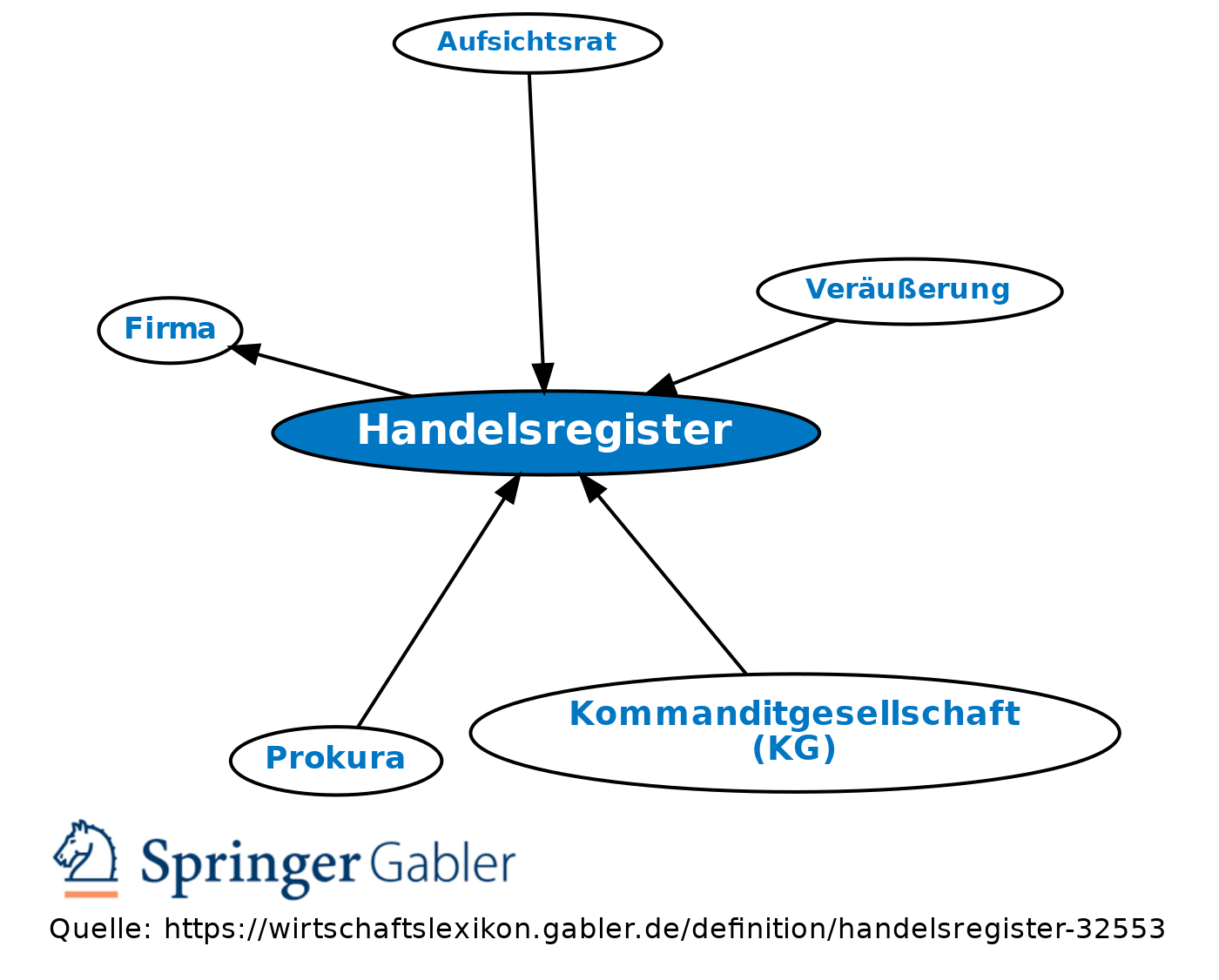

Handelsregister: A General Overview

The Handelsregister is a public register maintained by local district courts (Amtsgerichte) in Germany. Its purpose is to provide transparency and legal certainty regarding the essential details of registered businesses. Information contained within the Handelsregister is publicly accessible, allowing potential business partners, creditors, and customers to verify the legitimacy and key characteristics of a company. This includes information like the company's name, legal form, registered office, managing directors, and the amount of share capital (if applicable).

Registration in the Handelsregister is compulsory for certain types of businesses, primarily those classified as Kaufleute (merchants) under German commercial law (Handelsgesetzbuch - HGB). Registration confers certain rights and obligations, and it is critical to understand these to avoid potential legal consequences.

Handelsregister A (HRA)

What is Registered in HRA?

Handelsregister A (HRA) primarily contains information about the following types of business entities:

- Sole Proprietorships (Einzelunternehmen): Businesses owned and operated by a single individual, where the owner is personally liable for the company's debts.

- Partnerships (Personengesellschaften): This category includes various forms of partnerships, such as:

- General Partnerships (Offene Handelsgesellschaft - OHG): All partners are jointly and severally liable for the company's debts.

- Limited Partnerships (Kommanditgesellschaft - KG): One or more partners (Komplementäre) have unlimited liability, while other partners (Kommanditisten) have limited liability up to the amount of their capital contribution.

The key characteristic of entities registered in HRA is that the owners or partners typically bear direct and personal liability for the company's obligations. This means their personal assets are at risk if the business incurs debt.

Information Contained in HRA Entries

A typical entry in HRA will include the following information:

- Company Name (Firma): The official name under which the business operates. For sole proprietorships, this usually includes the owner's last name and at least one first name, and may include a business description. For partnerships, it can be a descriptive name or the names of the partners.

- Registered Office (Sitz): The official location of the company's headquarters.

- Business Purpose (Gegenstand des Unternehmens): A description of the company's main activities.

- Owner/Partners (Inhaber/Gesellschafter): The names and addresses of the owner (for sole proprietorships) or partners (for partnerships).

- Power of Representation (Vertretungsbefugnis): Information on who is authorized to represent the company legally (e.g., who can sign contracts). For OHGs, usually all partners can represent the company individually. For KGs, usually only the Komplementäre (general partners) have full power of representation.

- Date of Registration (Tag der Eintragung): The date when the company was officially entered into the Handelsregister.

Example:

Consider a sole proprietor named Max Schmidt who runs a bakery. His entry in HRA might look something like this: Firma: Max Schmidt Bäckerei; Sitz: Musterstadt; Gegenstand: Betrieb einer Bäckerei; Inhaber: Max Schmidt; Tag der Eintragung: 01.01.2024

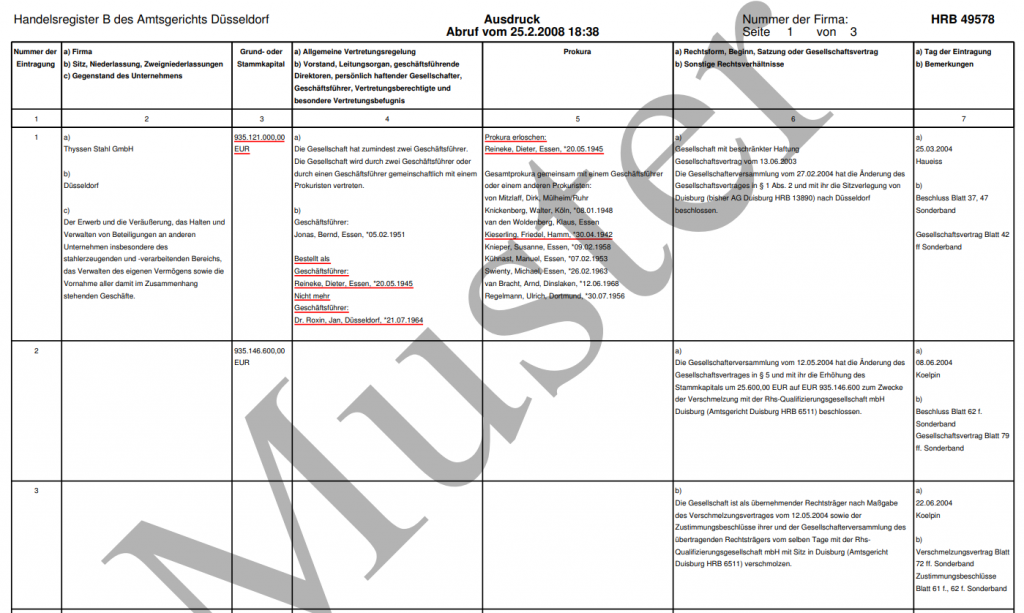

Handelsregister B (HRB)

What is Registered in HRB?

Handelsregister B (HRB) primarily contains information about corporations (Kapitalgesellschaften). These are legal entities separate from their owners, with limited liability. The most common types of corporations registered in HRB are:

- Limited Liability Companies (Gesellschaft mit beschränkter Haftung - GmbH): A very popular form of business entity in Germany, offering limited liability to its shareholders. The GmbH requires a minimum share capital of €25,000.

- Stock Corporations (Aktiengesellschaft - AG): A more complex form of corporation, typically used by larger companies. The AG requires a minimum share capital of €50,000.

- Entrepreneurial Company (limited liability) (Unternehmergesellschaft (haftungsbeschränkt) - UG (haftungsbeschränkt)): A simplified form of GmbH with lower initial capital requirements (theoretically as low as €1). However, it's legally obligated to accumulate reserves until it reaches the €25,000 minimum share capital required for a regular GmbH.

The key characteristic of entities registered in HRB is that the company itself is liable for its debts, and the shareholders' liability is generally limited to their capital contribution. This provides a significant level of protection for the owners.

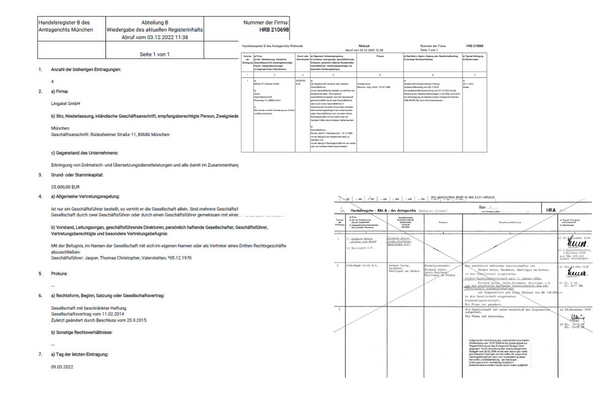

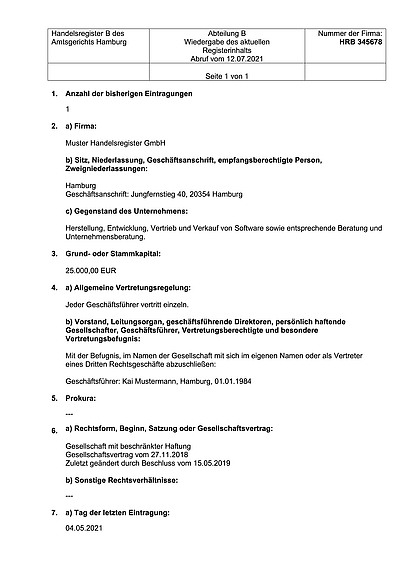

Information Contained in HRB Entries

A typical entry in HRB will include the following information:

- Company Name (Firma): The official name of the corporation, including the legal form (e.g., GmbH or AG).

- Registered Office (Sitz): The official location of the company's headquarters.

- Business Purpose (Gegenstand des Unternehmens): A description of the company's main activities.

- Share Capital (Stammkapital or Grundkapital): The amount of registered capital.

- Managing Directors (Geschäftsführer): The names and addresses of the individuals responsible for managing the company. Their powers and responsibilities are also usually detailed.

- Supervisory Board (Aufsichtsrat): (For AGs and certain larger GmbHs) The members of the supervisory board, which oversees the management board.

- Power of Representation (Vertretungsbefugnis): Information on who is authorized to represent the company legally. Usually, the managing directors can represent the company.

- Date of Registration (Tag der Eintragung): The date when the company was officially entered into the Handelsregister.

Example:

Consider a GmbH named "Musterfirma GmbH." Its entry in HRB might look something like this: Firma: Musterfirma GmbH; Sitz: Berlin; Gegenstand: Handel mit elektronischen Geräten; Stammkapital: 25.000 EUR; Geschäftsführer: Erika Müller; Tag der Eintragung: 15.02.2024

Why is it important to know the difference?

Understanding whether a company is registered in HRA or HRB is vital for several reasons:

- Liability: Knowing the legal form and which register the company is in immediately informs you about the liability of the owner(s)/partners/shareholders. This is crucial when assessing the risk of doing business with that entity.

- Legal Requirements: Different legal requirements apply to companies registered in HRA versus HRB. This includes accounting obligations, reporting requirements, and management responsibilities.

- Public Information: The Handelsregister provides publicly accessible information. Knowing which register to search in is the first step in finding the relevant details about a company.

- Due Diligence: When entering into a business relationship, conducting due diligence is essential. Checking the Handelsregister entry is a fundamental step in verifying the legitimacy and financial standing of a company.

- Contractual Agreements: The Handelsregister entry confirms who has the power to represent the company and sign legally binding agreements.

Accessing the Handelsregister

The Handelsregister is publicly accessible online through the Gemeinsames Registerportal der Länder (Joint Register Portal of the Federal States). This portal provides access to company registers from all German states. You can search for companies by name, registered office, or registration number. Accessing basic information is usually free, but downloading official documents may require a fee.

Conclusion

The distinction between Handelsregister A and Handelsregister B is fundamental to understanding the structure and liability associated with different types of businesses in Germany. By knowing which register applies to a specific company, you can quickly ascertain its legal form, the extent of liability, and other key information. This knowledge is essential for anyone doing business in Germany, whether you are an entrepreneur, investor, or simply a customer. Remember to utilize the publicly available resources of the Handelsregister for due diligence and to ensure you are well-informed when engaging with German businesses.

![Kg Handelsregister A Oder B Handelsregister • Erklärung, Aufbau & Eintragung · [mit Video]](https://blog.assets.studyflix.de/wp-content/uploads/2024/02/WP_Aufbau-Handelsregister-1024x576.jpg)