Vor Und Nachteile Der Ag

Willkommen! Considering setting up shop in Germany, even if just temporarily? You'll quickly encounter the term "AG," short for Aktiengesellschaft. It's a common legal structure for businesses here, and understanding its pros and cons is crucial, whether you're a budding entrepreneur, an investor, or simply curious about the German business landscape. Let’s dive into the Vor- und Nachteile (advantages and disadvantages) of an AG.

Was ist eine Aktiengesellschaft (AG)?

First things first: what exactly is an AG? In simple terms, it's a stock corporation. This means the company's capital is divided into shares (Aktien). Shareholders own these shares and are thus part-owners of the company. Crucially, the AG itself is a legal entity separate from its shareholders, meaning it can enter into contracts, own property, and be sued in its own right.

Think of it like this: imagine a group of friends pooling their money to start a bakery. If they formed an AG, the bakery would be its own legal entity, capable of hiring staff, buying ovens, and selling bread, completely separate from the friends who initially invested. The friends, as shareholders, would receive a portion of the bakery's profits (dividends) based on the number of shares they own.

Vorteile der AG (Advantages of an AG)

1. Begrenzte Haftung (Limited Liability)

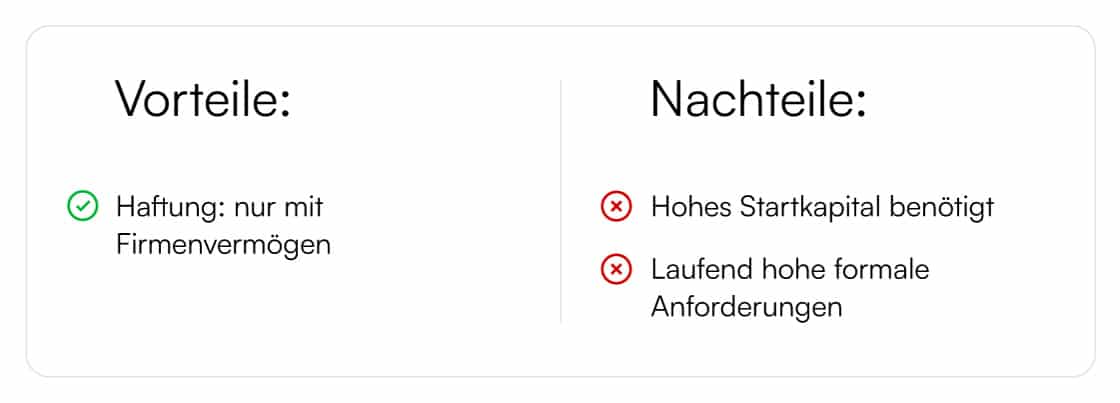

This is arguably the biggest advantage of an AG. Shareholders are only liable up to the amount of their investment. If the AG goes bankrupt, creditors cannot come after the personal assets of the shareholders. This offers significant protection and makes it an attractive structure for attracting investment.

This limited liability is a major draw for investors who are wary of the risks associated with unlimited liability, which is common in other legal structures.

2. Einfache Kapitalbeschaffung (Easy Capital Acquisition)

AGs can raise capital by issuing new shares on the stock market. This makes it easier to access large sums of money for expansion, research and development, or acquisitions. Compared to smaller business structures, attracting investors to an AG is generally simpler due to the transparency and regulatory oversight involved.

3. Hohe Reputation und Vertrauen (High Reputation and Trust)

An AG is generally perceived as a more serious and credible business than, say, a sole proprietorship (Einzelunternehmen) or a limited liability company (GmbH). This enhanced reputation can be invaluable when dealing with customers, suppliers, and banks. The rigorous requirements and mandatory audits associated with an AG signal stability and professionalism.

4. Übertragbarkeit von Anteilen (Transferability of Shares)

Shares in an AG are generally freely transferable, meaning shareholders can easily sell their shares to other parties. This liquidity makes investing in an AG more attractive. However, restrictions on transferability may exist in the company's articles of association (Satzung). This Satzung is crucial and should be carefully reviewed by potential investors.

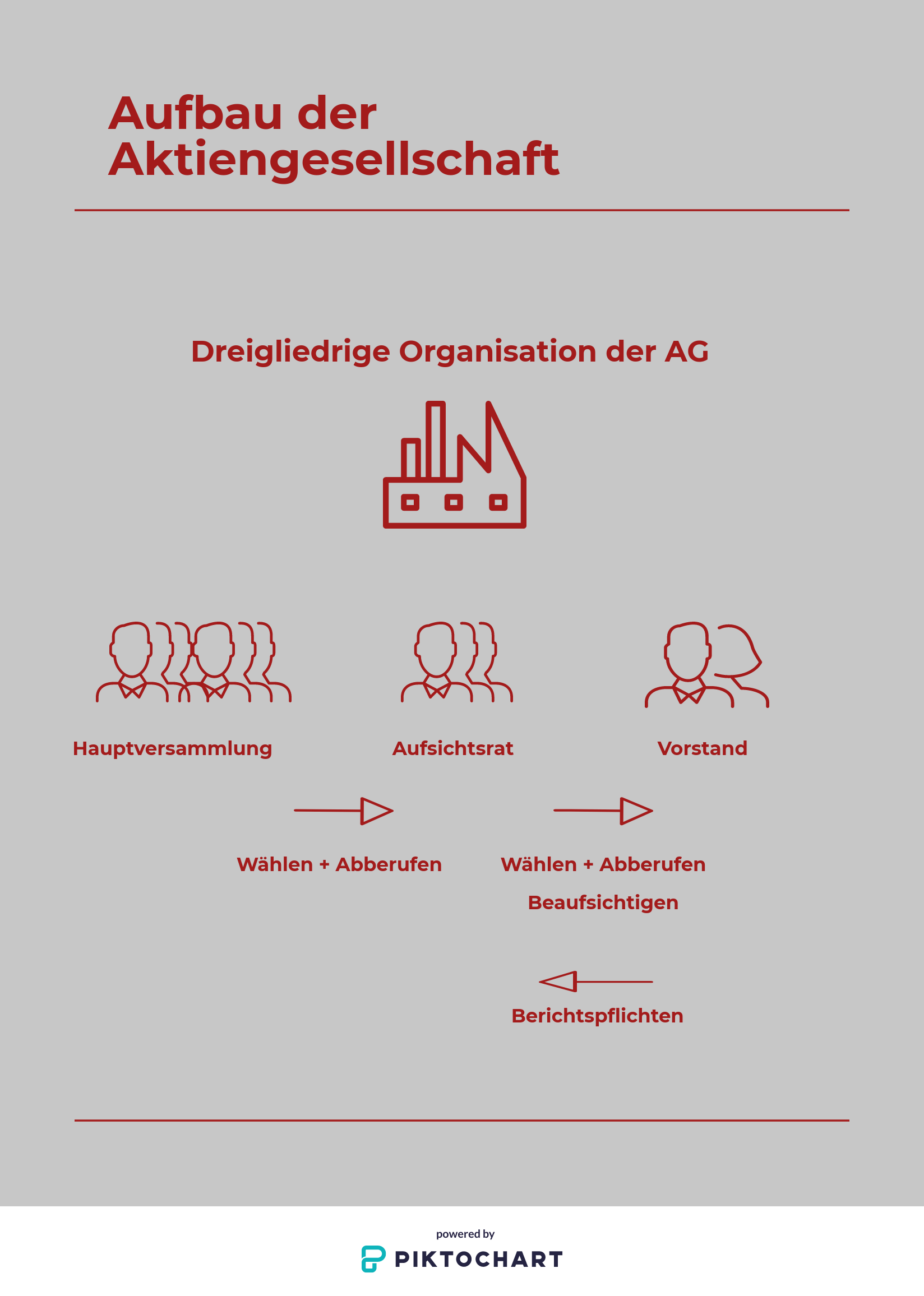

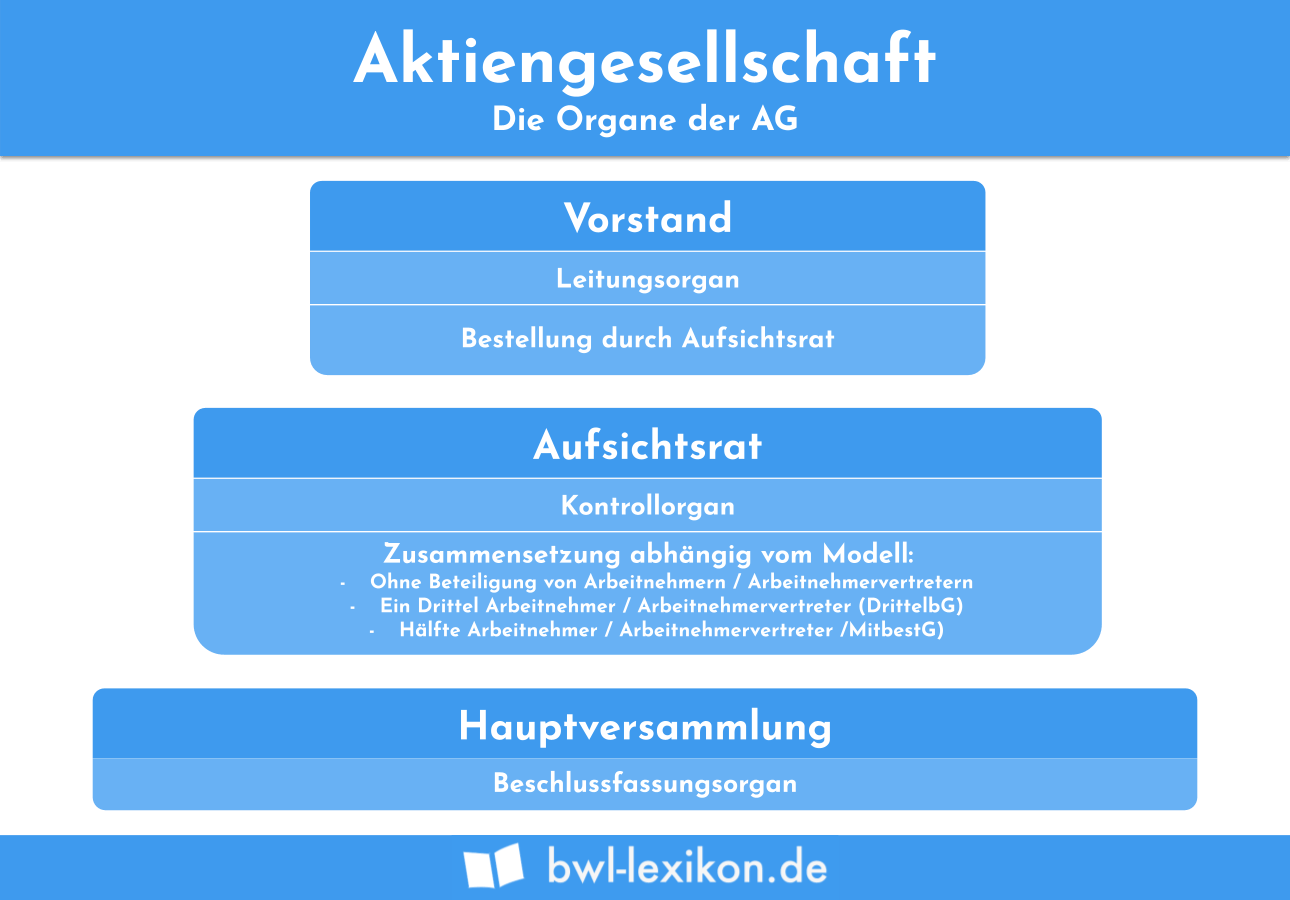

5. Klare Organisationsstruktur (Clear Organizational Structure)

An AG has a clearly defined organizational structure, with a management board (Vorstand), a supervisory board (Aufsichtsrat), and a shareholders' meeting (Hauptversammlung). This structure ensures accountability and transparency, which can be particularly appealing to larger investors.

Nachteile der AG (Disadvantages of an AG)

1. Hohe Gründungskosten (High Setup Costs)

Setting up an AG is significantly more expensive than establishing other types of businesses. There are notary fees, court registration fees, and the cost of preparing the articles of association (Satzung), which typically requires legal expertise. The minimum share capital required for founding an AG is €50,000, which needs to be available upfront.

2. Umfassende Regulierung und Bürokratie (Extensive Regulation and Bureaucracy)

AGs are subject to strict regulatory requirements and extensive reporting obligations. They must publish annual financial statements, undergo regular audits, and comply with numerous laws and regulations. This can be time-consuming and costly, requiring dedicated personnel or outsourcing to specialized firms. The administrative burden can be a significant drain on resources, especially for smaller AGs.

3. Transparenz und Offenlegungspflichten (Transparency and Disclosure Obligations)

AGs are required to disclose a significant amount of information about their operations, finances, and governance to the public. This transparency, while beneficial for investors, can also provide competitors with valuable insights into the company's strategies and performance. There's a constant balancing act between transparency and protecting commercially sensitive information.

4. Einfluss von Kleinaktionären (Influence of Minority Shareholders)

While large shareholders typically wield more influence, even small shareholders have certain rights and can potentially disrupt decision-making processes, particularly at the shareholders' meeting (Hauptversammlung). This can lead to delays and conflicts, especially if there are disagreements about strategy or management.

5. Mögliche Interessenkonflikte (Potential Conflicts of Interest)

Conflicts of interest can arise between the management board (Vorstand), the supervisory board (Aufsichtsrat), and the shareholders. For example, the management board may prioritize short-term profits over long-term sustainability, or the supervisory board may not adequately monitor the management's performance. Navigating these potential conflicts requires strong corporate governance and a commitment to ethical behavior.

Für Wen ist die AG Geeignet? (Who is the AG Suitable For?)

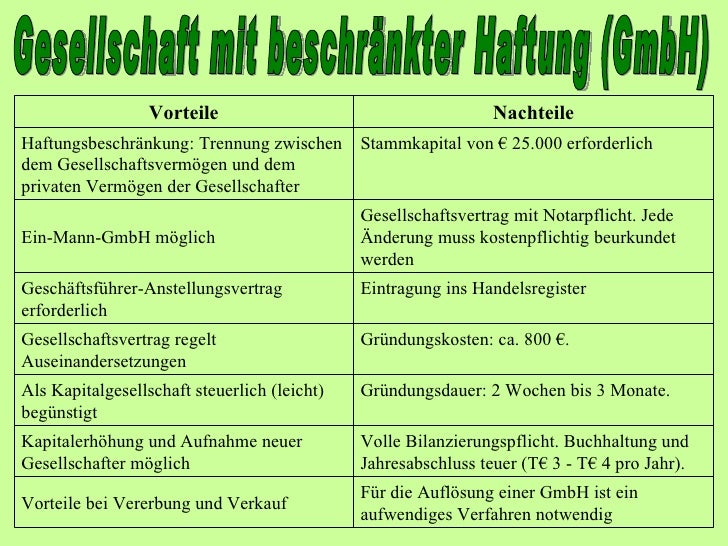

The AG structure is best suited for large companies that require significant capital and have a long-term vision for growth. It's a popular choice for companies seeking to list on the stock exchange and attract institutional investors. It is generally not recommended for small businesses or startups with limited capital and a simple organizational structure. Smaller businesses often find the GmbH (limited liability company) a more suitable and less burdensome option.

Alternative Rechtsformen (Alternative Legal Structures)

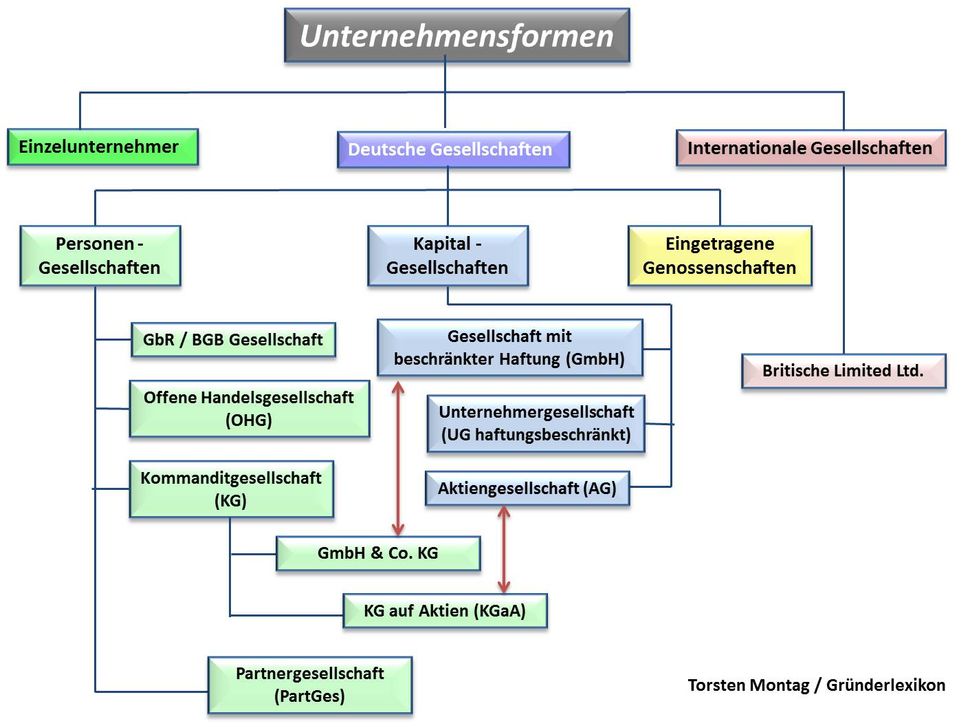

Before deciding on an AG, consider other legal structures available in Germany, such as the:

- GmbH (Gesellschaft mit beschränkter Haftung): A limited liability company, similar to an LLC in the US. It's a popular choice for small and medium-sized businesses due to its lower setup costs and less stringent regulatory requirements compared to the AG.

- UG (Unternehmergesellschaft): A type of GmbH with a lower minimum share capital requirement (as low as €1). It's often referred to as a "mini-GmbH" and is suitable for startups and entrepreneurs with limited capital.

- KG (Kommanditgesellschaft): A limited partnership.

- OHG (Offene Handelsgesellschaft): A general partnership.

- Einzelunternehmen (Sole Proprietorship): A simple structure for individual business owners.

Each of these has its own set of advantages and disadvantages, so it's essential to carefully evaluate your needs and objectives before making a decision.

Fazit (Conclusion)

The AG is a powerful legal structure that offers significant advantages in terms of limited liability, capital acquisition, and reputation. However, it also comes with high setup costs, extensive regulation, and demanding transparency requirements. Carefully weigh the Vor- und Nachteile before deciding if an AG is the right choice for your business. Seeking advice from a qualified German lawyer and tax advisor is highly recommended. Gute Reise and viel Erfolg (Good travels and good luck) in your business endeavors in Germany!