Arbeitslos Vor Rente Mit 63 Und 45 Jahre Voll

Herzlich willkommen! You're likely here because you're curious about a specific aspect of the German social security system: transitioning into retirement early, specifically at 63, after being unemployed and having contributed to the system for 45 years. This is a significant topic, and while it primarily applies to German residents and workers, understanding it can be helpful if you're planning a longer stay, considering working in Germany, or simply interested in the intricacies of the German social welfare state. Let's break down this somewhat complex subject in a clear and accessible way.

The Core Concept: Arbeitslos Vor Rente Mit 63 Und 45 Jahre Voll

This phrase, "Arbeitslos vor Rente mit 63 und 45 Jahre voll," directly translates to "Unemployed before retirement at 63 with 45 years complete." It refers to a specific pathway to early retirement in Germany under certain conditions. Essentially, it describes a scenario where someone is unemployed *before* reaching the standard retirement age but *after* meeting the criteria to retire at 63 with 45 years of contributions.

Key Components Unpacked:

- Arbeitslos (Unemployed): This means the individual is officially registered as unemployed with the German Employment Agency (Bundesagentur für Arbeit). This is crucial. Simply not working is not the same as being registered as unemployed.

- Vor Rente Mit 63 (Before Retirement at 63): The individual must be approaching the age of 63 and intending to retire at that age. This option is not available to everyone, but rather for those with a specific contribution history.

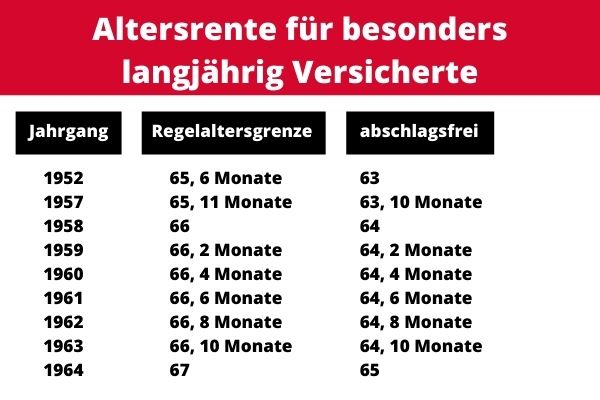

- Und 45 Jahre Voll (And 45 Years Complete): This is the cornerstone of this retirement path. The individual needs to have accumulated at least 45 years of contributions to the German statutory pension insurance (Gesetzliche Rentenversicherung). These are not necessarily 45 years of continuous employment.

It's important to understand that this isn't an automatic right. Certain conditions must be met, and it's not always the most financially advantageous option. However, for many, it provides a vital safety net and a way to retire somewhat earlier than the standard retirement age.

The 45 Years: What Counts Towards Qualification?

The "45 years" requirement is the most critical factor. But what exactly counts towards those 45 years? It's not just about full-time employment. Here's a breakdown of what generally counts:

- Employment Subject to Social Security Contributions (Pflichtbeitragszeiten): This is the primary element. These are years where you were employed and paying into the German pension system.

- Child-Rearing Periods (Kindererziehungszeiten): These are credited to parents (typically the mother) for raising children born after 1992. The exact amount credited can vary.

- Periods of Caregiving (Pflegezeiten): Time spent caring for a close relative who requires long-term care can also count towards the 45 years.

- Periods of Unemployment Benefit Receipt (Zeiten des Bezugs von Arbeitslosengeld I): Generally, receiving unemployment benefits (Arbeitslosengeld I) counts towards your contribution years. However, there are specific rules. Usually, the last two years before retirement are *not* counted, unless the unemployment was due to company insolvency or a similar reason.

- Periods of Sickness Benefit Receipt (Zeiten des Bezugs von Krankengeld): Time spent receiving sickness benefits (Krankengeld) can also be included.

- Substitute Service (Wehr- oder Zivildienst): Time spent fulfilling mandatory military service or alternative civilian service counts.

Important Note: This is a general overview. The specific rules and regulations surrounding what counts towards the 45 years can be complex and are subject to change. It's always best to consult with the German Pension Insurance (Deutsche Rentenversicherung) for personalized advice.

The Unemployment Element: Navigating the System

Becoming unemployed right before reaching the age of 63 can be stressful. Here's what you need to know if you're facing this situation:

- Register with the Employment Agency (Bundesagentur für Arbeit): This is the first and most crucial step. You must register as unemployed to be eligible for unemployment benefits (Arbeitslosengeld I) and for the "Arbeitslos vor Rente" option.

- Attend Counseling Sessions: The Employment Agency will require you to attend counseling sessions to discuss your job search prospects and potential training opportunities.

- Actively Seek Employment: Even if you're close to retirement, you are generally expected to actively look for work while receiving unemployment benefits. There are some exceptions to this rule as you get closer to retirement age, but you should discuss these with your case worker.

- Consider Early Retirement Options: Discuss your options for early retirement with the German Pension Insurance (Deutsche Rentenversicherung). They can calculate your potential pension benefits and advise you on the best course of action.

It's important to note that the Employment Agency may encourage you to take on temporary or part-time work. Accepting such work may affect the amount of your unemployment benefits, but it can also help to bridge the gap to retirement. Discuss these implications carefully with your case worker.

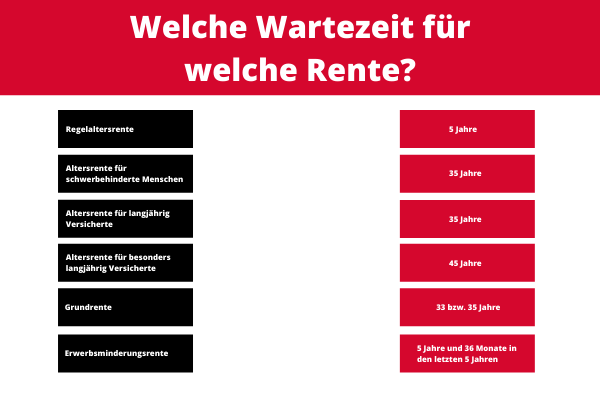

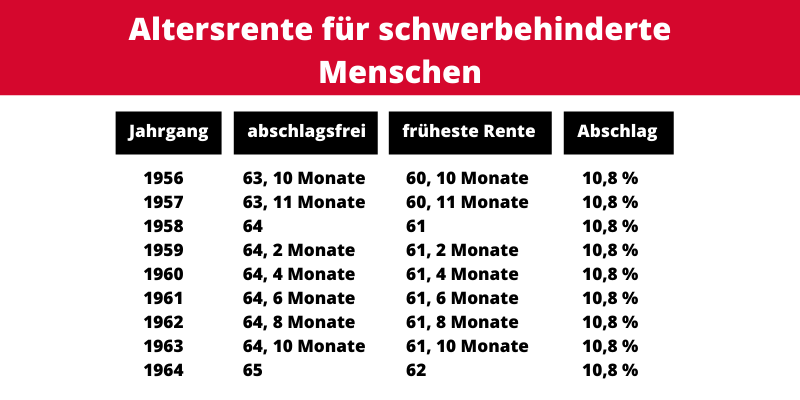

Financial Implications: Pension Deductions

Retiring early, even with 45 years of contributions, generally results in pension deductions (Abschläge). The earlier you retire, the larger the deductions will be. These deductions are applied to your monthly pension payment for the rest of your life.

The exact amount of the deductions depends on how many months you retire before the standard retirement age (Regelaltersgrenze). For each month of early retirement, there is usually a deduction of 0.3%. For example, retiring one year (12 months) early would result in a 3.6% deduction. These deductions can be significant, so it's crucial to understand the financial implications before making a decision.

It is highly recommended to request a pension forecast (Renteninformation) from the Deutsche Rentenversicherung to understand the potential impact of early retirement on your pension benefits.

Is This the Right Choice for You? Factors to Consider

Deciding whether to retire early under this scheme is a personal decision that depends on your individual circumstances. Here are some factors to consider:

- Your Financial Situation: Can you afford to live on a reduced pension income? Do you have other sources of income or savings to supplement your pension?

- Your Health: Are you physically and mentally able to continue working?

- Job Prospects: What are your chances of finding another job at your age and with your qualifications?

- Pension Deductions: How much will your pension be reduced if you retire early? Can you live comfortably with that reduced amount?

- Alternatives: Are there other options available to you, such as part-time work, bridge pensions, or other social security benefits?

Who Can Provide More Information?

Several resources are available to help you navigate the German pension system and understand your options:

- Deutsche Rentenversicherung (German Pension Insurance): This is the primary source of information about German pensions. They offer personalized advice, pension forecasts, and application forms. Their website (deutsche-rentenversicherung.de) is a valuable resource, though often available only in German.

- Bundesagentur für Arbeit (German Employment Agency): If you are unemployed, the Employment Agency can provide information about unemployment benefits and job search assistance.

- Independent Pension Advisors (Unabhängige Rentenberater): These advisors can provide independent and impartial advice about your pension options. Be aware that they typically charge a fee for their services.

- Consumer Advice Centers (Verbraucherzentralen): These centers offer free or low-cost advice on a wide range of consumer issues, including pensions.

A Note for Tourists and Short-Term Visitors

This information is primarily relevant to individuals who have worked and contributed to the German social security system for a significant period. If you are a tourist or planning a short stay in Germany, this information is unlikely to be directly applicable to you. However, understanding the basics of the German social security system can provide a broader perspective on the country's social policies and values.

While you may not be eligible for these specific retirement benefits, it's worth noting that Germany has a robust social safety net that provides support to its citizens and residents in various situations, including unemployment, sickness, and old age.

In Conclusion: Understanding the System

The "Arbeitslos vor Rente mit 63 und 45 Jahre voll" option provides a pathway to early retirement for individuals who meet specific criteria. While it may seem complex, understanding the key components – unemployment, age, and contribution years – is crucial. It is essential to seek personalized advice from the Deutsche Rentenversicherung to determine your eligibility and the potential financial implications before making any decisions. Retirement is a significant life event, and careful planning is paramount to ensure a secure and comfortable future.

Hopefully, this guide has provided you with a clearer understanding of this important aspect of the German social security system. Good luck!