Wieviel Darf Eine Unterhaltsberechtigte Person Verdienen

Hallo zusammen! Planning a trip to Germany or perhaps already enjoying the *Gemütlichkeit*? Maybe you're even thinking about a longer stay or permanent move? One thing that might pop into your head, especially if you have family or friends here who are financially supporting you, is: "Wieviel darf ich eigentlich verdienen, ohne dass das deren Unterhaltspflicht beeinflusst?" (How much can I earn without affecting their obligation to provide maintenance?). Don't worry, we're here to break it down for you in a simple and easy-to-understand way!

Understanding Unterhalt: The Basics

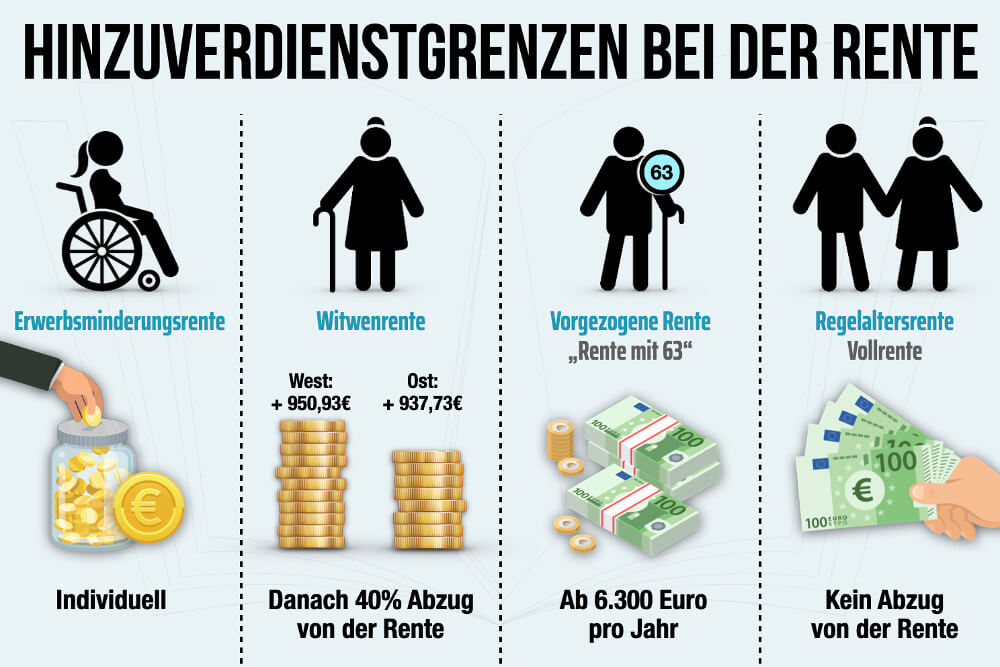

Before diving into the specifics of earnings limits, let's quickly clarify what "Unterhalt" (maintenance) actually means in the German context. Unterhalt is a financial support obligation, usually between family members. It's most commonly associated with child support after a divorce, but it can also apply to spouses after separation or divorce, and even, in certain situations, to parents who require financial assistance from their children. The key concept is that someone is legally obligated to financially support another person because they are unable to support themselves. For our purposes, we're primarily focused on how *your* earnings might impact someone else's obligation to support *you*.

Who is a "Unterhaltsberechtigte Person"?

A "Unterhaltsberechtigte Person" is simply the individual *receiving* the maintenance payments. This could be a child, a former spouse, or even a parent, as mentioned above. If you're relying on someone for financial support in Germany, even temporarily, you're potentially considered a "Unterhaltsberechtigte Person."

The Million-Euro Question: How Much Can You Earn?

Now, let's get to the core question: how much can you earn as a "Unterhaltsberechtigte Person" without jeopardizing the financial support you're receiving? There's no single, magic number, unfortunately. The answer depends on several factors, making it a somewhat complex issue. The most important principle is this: the Unterhaltspflicht (obligation to provide maintenance) is reduced or eliminated if the person receiving the support can cover their own needs.

Key Factors Influencing the Earnings Limit

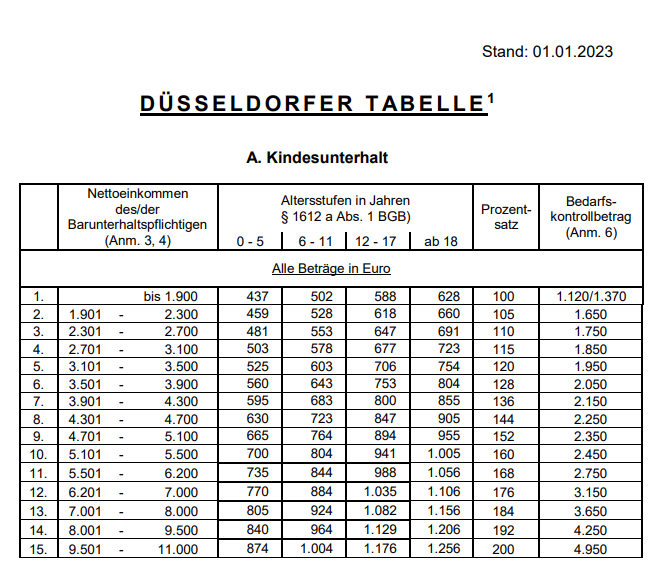

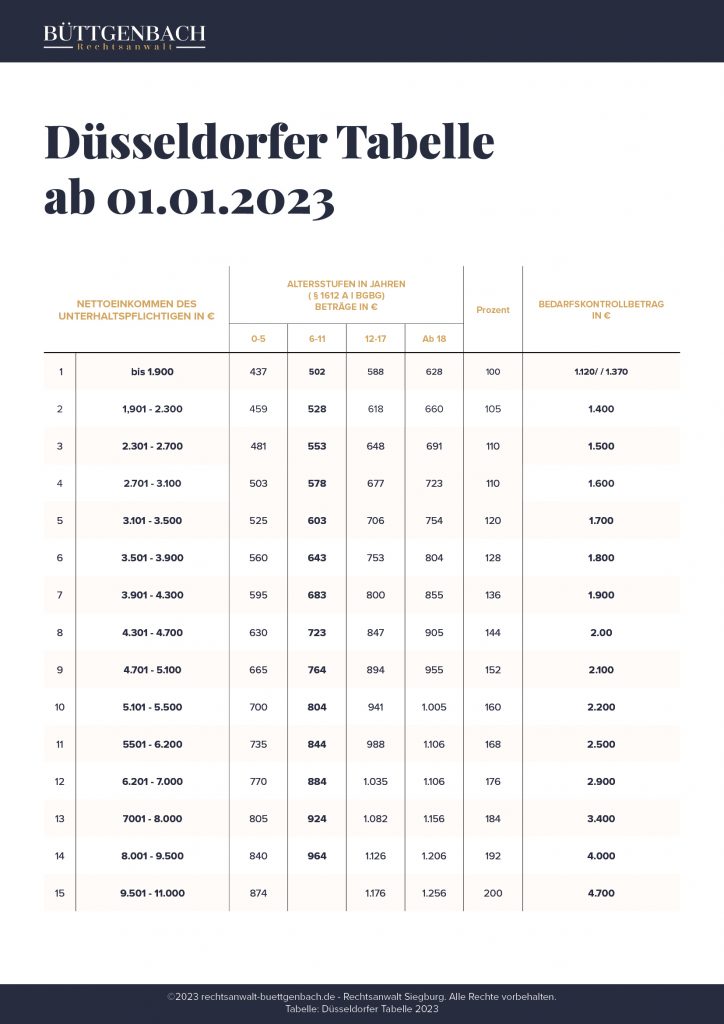

Here's a breakdown of the key factors a German court would consider when determining if your income affects your Unterhaltsanspruch (claim to maintenance):

- Your Needs (Bedarf): This is the amount of money you need to cover your basic living expenses. This includes rent, utilities, food, clothing, health insurance, transportation, and other essential costs. The higher your needs, the more you can potentially earn without impacting the Unterhaltszahlungen (maintenance payments).

- Your Income (Einkommen): This includes *all* sources of income. This includes your salary from employment (net income after taxes and social security contributions), income from self-employment, investment income (interest, dividends), rental income, and even certain social benefits. Every Euro counts!

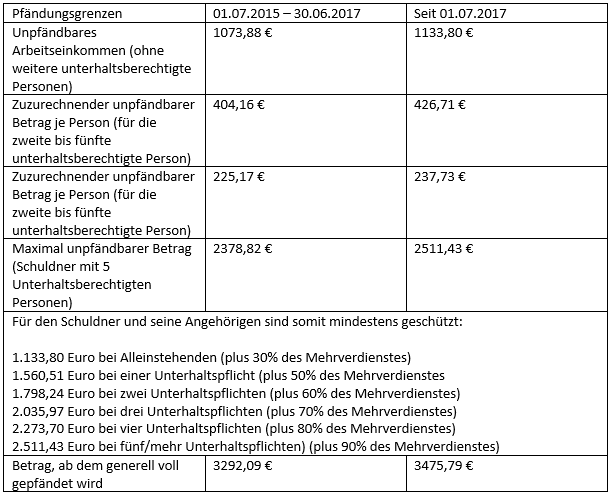

- The Income of the Unterhaltspflichtiger (Person Obligated to Pay): The financial capacity of the person providing support is crucial. If they are already struggling to make ends meet, even a small amount of income on your part could significantly reduce or eliminate their obligation.

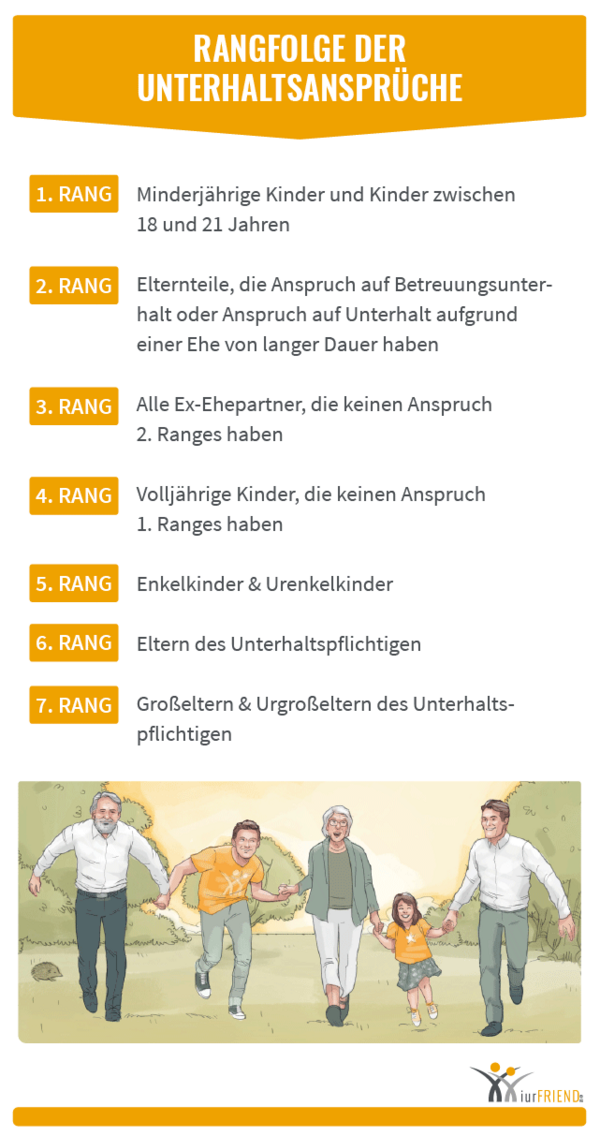

- Your Age and Circumstances: Are you a child in education? Are you a divorced spouse who is unable to work due to illness or disability? These factors play a significant role. For example, a child still in school is generally not expected to contribute to their own support.

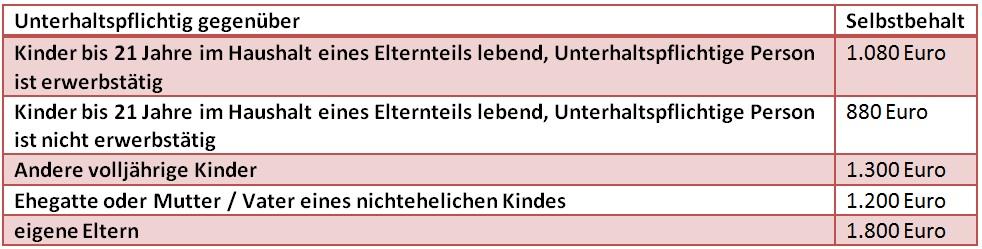

- The "Selbstbehalt" (Self-Retention): This is a minimum amount of income the Unterhaltspflichtiger is allowed to keep for their own living expenses. The Selbstbehalt varies depending on the relationship (child, spouse, parent) and the individual circumstances. This acts as a safety net for the person paying the maintenance.

Specific Examples and Guidelines

While a definitive "earnings limit" is difficult to pinpoint, here are some general guidelines and examples:

* Children: For children who are minors and living with a parent, almost all income will be considered towards meeting their needs. However, minor income from a part-time job that serves as pocket money is often disregarded. Once a child reaches adulthood (18 years old), they are expected to contribute to their own support if they are capable of doing so. If an adult child is in education or vocational training (Ausbildung), the parents usually still have an obligation to provide support, but the child's income from part-time work will be taken into account. * Spouses: After a divorce, the situation is more complex. Generally, a former spouse is expected to become self-sufficient. However, if they are unable to work due to age, illness, or the need to care for young children, they may be entitled to spousal maintenance. The amount they can earn without affecting maintenance depends on their individual circumstances and the standard of living during the marriage. * Parents: Adult children are obligated to support their parents if the parents are unable to support themselves. The child's income and financial circumstances are carefully considered, and the parents are expected to utilize any available social benefits before seeking support from their children.The Importance of "Angemessene Erwerbstätigkeit" (Reasonable Employment)

German law expects individuals who are capable of working to actively seek employment and contribute to their own support. This is referred to as "Angemessene Erwerbstätigkeit." This means you can't simply choose not to work and expect someone else to foot the bill. If you are deemed capable of earning income, a court may *impute* income to you, even if you are not actually earning it. This means they will calculate what you *could* be earning if you were reasonably employed, and use that figure to determine your Unterhaltsanspruch.

Dealing with Mini-Jobs (Minijobs)

A Minijob is a form of part-time employment in Germany where the income is capped at a certain amount (currently €520 per month). Minijobs are often tax-free and exempt from social security contributions for the employee. However, the income from a Minijob *is* considered income for Unterhalts purposes. While it might not seem like much, even a small amount of income from a Minijob can reduce the amount of maintenance you are entitled to receive.

Tips for Travelers and Expats

So, what does this all mean for you as a tourist, expat, or someone planning a longer stay in Germany?

* Be Transparent: If you are receiving financial support from someone in Germany, be open and honest about any income you are earning. Hiding income can lead to serious legal consequences. * Keep Records: Keep detailed records of all your income and expenses. This will be helpful if there are any questions about your financial situation. * Seek Legal Advice: If you are unsure about your rights and obligations regarding Unterhalt, consult with a German lawyer specializing in family law (Familienrecht). A lawyer can provide personalized advice based on your specific situation. * Consider the Implications: Even if you are only staying in Germany for a short period, your income can affect the financial support you are receiving. Plan accordingly and be mindful of the impact on the person providing the support.Where to Find More Information

Here are some useful resources (in German) for further research:

* Deutscher Anwaltverein (German Bar Association): https://www.anwaltverein.de/ (Find a lawyer specializing in Familienrecht) * Bundesministerium der Justiz (Federal Ministry of Justice): https://www.bmj.de/ (Information on German law) * Various legal websites and forums: Search for terms like "Unterhalt," "Unterhaltsberechnung," and "Einkommen" to find specific information.Final Thoughts

Navigating the complexities of Unterhalt in Germany can seem daunting, but hopefully, this guide has provided a clearer understanding of the key factors and principles involved. Remember, the specific amount you can earn without impacting your maintenance depends on your individual circumstances. When in doubt, always seek professional legal advice. Enjoy your time in Germany!

Disclaimer: This article is for informational purposes only and does not constitute legal advice. You should consult with a qualified German lawyer to obtain advice specific to your situation.

![Wieviel Darf Eine Unterhaltsberechtigte Person Verdienen Bürgergeld: Höhe, Gesetz und Antrag 2025 [+Tabelle]](https://cdn.prod.website-files.com/6536380a284b0413bf06e844/6536531fb55fc64b2d750fc7_63efaa319b3ae5b5af1ec36c_Ho%25CC%2588he-Bu%25CC%2588rgergeld-2023.webp)